Dr Richard Tooth explains why increasing block tariffs (IBTs) are neither fair nor efficient

People might expect to pay a lower rate (i.e. price per unit) for a service by buying in bulk. But for some utility services, the reverse applies, whereby customers pay a higher rate for higher volumes. For example, the rate Canberra residents pay for water doubles for usage that is in excess of 50 kL per quarter.

In Australia, this pricing structure known as an increasing, or inclining, block tariff (IBT) is applied by around half of the water utilities. In the UK – where it is known as a rising block tariff – there is increasing interest and debate on using it in the water [1] and energy [2] sectors.

Generally, two arguments are made in favour of IBTs. One is that it is fairer on the basis that under an IBT an ‘essential’ level of use is sold at a discount, while higher ‘discretionary’ use is charged more, thereby advantaging the smaller users who tend to be poorer. The other argument is that the higher price on discretionary use provides a strong signal to conserve the resource.

Around ten years ago, Hugh Sibly and I, in a peer-reviewed academic paper [3], demonstrated that IBTs were neither fair nor efficient relative to a simple alternative. That paper was fairly technical, and while commonly cited, clearly hasn’t halted the interest in IBTs. This article is an attempt to demonstrate the issues in a simpler style.

“Contrary to common perception, IBTs result in higher bills for the small users (who tend to have lower incomes) due to the impact of IBTs on fixed charges.”

Sapere

The rationale for an IBT

The main alternative to the IBT for utility pricing is a ‘two-part tariff’ involving a single volumetric price for usage and a fixed connection charge (also known as a standing charge) that is independent of usage. In utility price setting, it is common to first determine the usage prices with the aim of encouraging efficient use and then set the fixed charges (which are unlikely to affect consumer decisions) to recover the remaining required revenue.

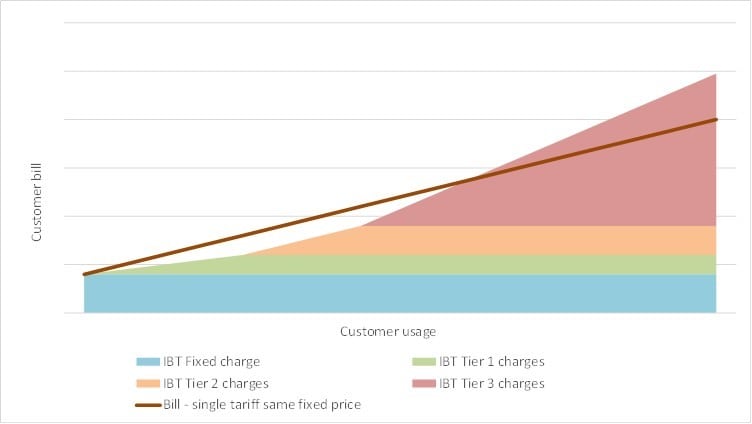

The common argument for an IBT is illustrated using an example in the figure below. The figure shows how a customer’s bill varies with use for an IBT (the shaded areas) and for an alternative single usage price tariff that has the same fixed charge (the solid line). In this example, there are three IBT tiers for which different usage prices apply, reflected by the changing slope of the shaded areas. The single usage price option has a constant slope, which is equal to the Tier 2 price in this example.

The IBT may be perceived as desirable because, relative to the alternative presented, it appears to incentivise a greater overall level of conservation (which is often seen as a goal in itself) while reducing the bills for small users.

However, the attractiveness of the IBT depends on what it is compared to. There is no requirement that the fixed charge is the same under the IBT and the single price alternative. Rather there is always an alternative option (hereafter the ‘efficient tariff’ option) consisting of a single usage price (hereafter the ‘efficient price’) and fixed charge that delivers the same overall level of conservation and revenue as the IBT.

The prices for this option can be found with some modelling that accounts for the distribution of customer demand and how customers respond to prices.

The financial impacts of an IBT

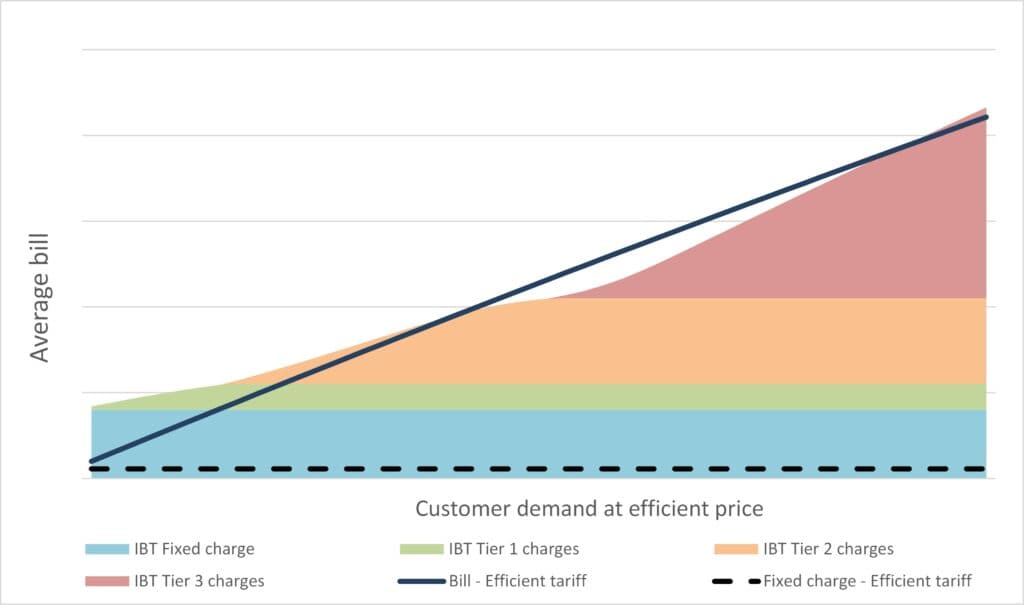

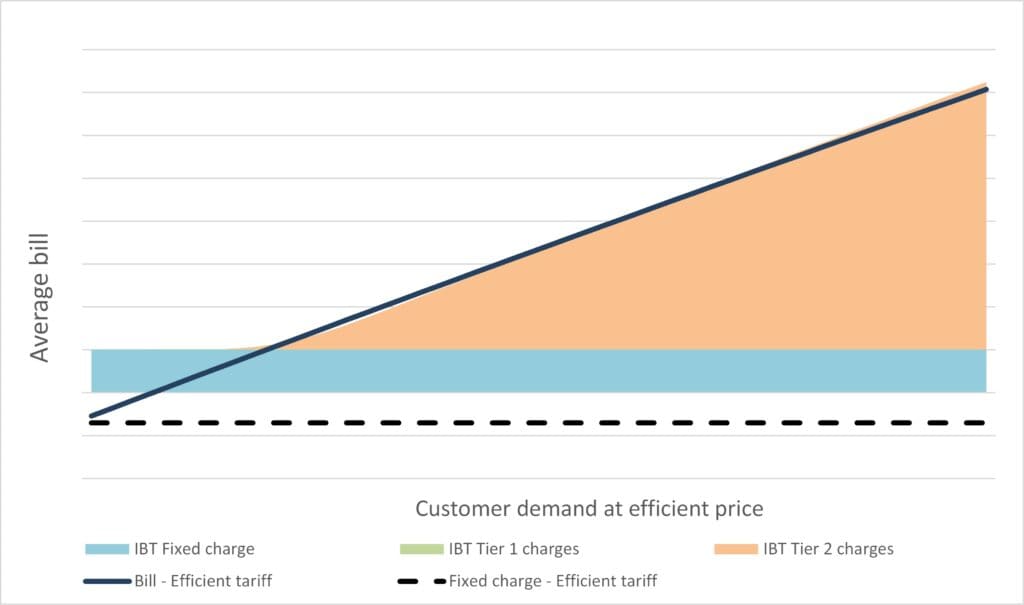

A comparison of the bill by customer for the IBT and efficient tariff is illustrated in the following figure. To enable a comparison by customer, the horizontal axis has been set to the customer demand at the efficient price. Thus, the difference in the height of the shaded area and the solid black line represents the difference in the bill for the two options for a customer.

With any reasonable set of assumptions there are some common key results. Invariably the fixed charge for efficient tariff option is below the IBT’s fixed charge, and consequently the IBT invariably results in higher bills for small users and lower bills for some group with reasonably high usage. The impact on very large users is more sensitive to the choices and assumptions. The very largest users pay more under an IBT, but a significant portion of large users may, over time, pay less under an IBT as they cut-back usage in response to price.

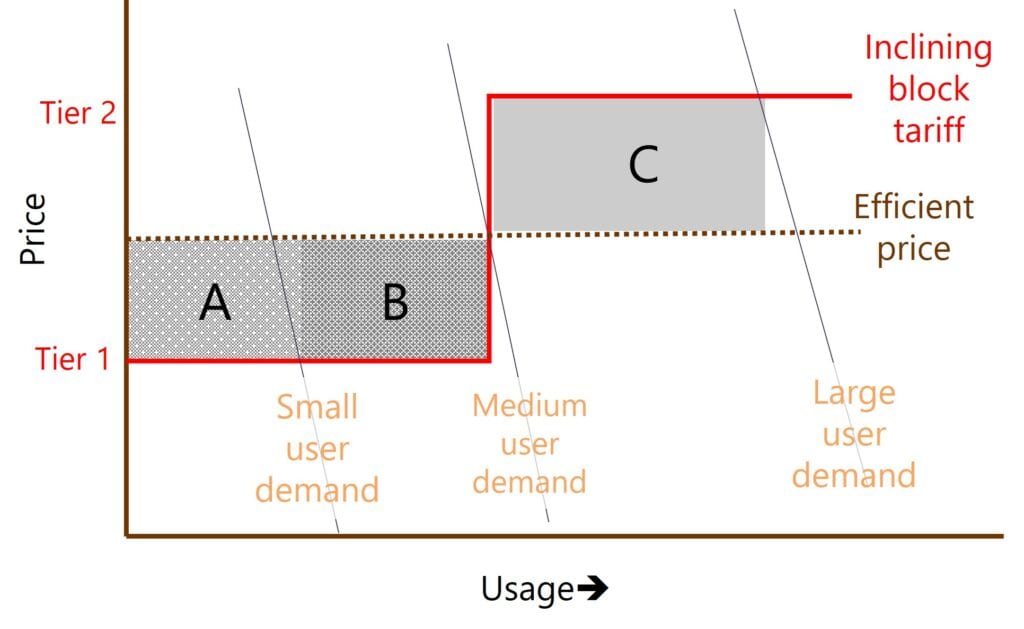

The key result may be most easily understood using the following figure and considering the implications for the fixed charge under an IBT. The figure examines prices and usage under a two-tier IBT and the efficient tariff for customers with three different levels of demand (small, medium and large) illustrated by the sloping lines. To achieve the same conservation outcome the efficient price must be between the low (Tier 1) and high (Tier 2) prices. Consequently, relative to the efficient price tariff, the IBT has the effect of subsidising the usage charges associated with consumption in the lower tier and taxing the usage charges associated with consumption in the higher tier.

Now consider for the three customer types, the impact of an IBT on the revenue collected from usage charges (excluding the fixed charge). Under the IBT, relative to the efficient tariff, a small user receives a subsidy equal to the area A; a medium user receives a subsidy equal to A + B; the large user receives a subsidy equal to A + B and pays a tax equal to C. To maintain the same revenue, the difference in fixed charges collected need to offset the difference in usage charges collected. To prevent a higher fixed charge under the IBT, the utility needs to collect enough extra ‘tax’ revenue from all the large users (area C) to offset all the subsidies provided to all small users (area A) and medium and large users (areas A and B). In practice, this is not feasible and so the IBT inevitably leads to a higher fixed charge and higher bills for the small users.

Perhaps counterintuitively, increasing the Tier 2 price to increase area C leads to higher fixed charges under the IBT. Increasing the Tier 2 price reduces the large user demand, which necessitates a decrease in the Tier 1 price so as to retain the same conservation outcome. A decrease in the Tier 1 price increases the areas A and B, which increases the additional amount to be recovered by the fixed charge.

Are there any conditions under which the IBT could lead to lower bills for small users? For this to occur, small user demand would need to be very responsive to price changes and large user demand very unresponsive. However, by their nature, large users can reduce their demand by more than small users and the evidence, at least from the water sector, is that in even in percentage terms large properties (which use more water) tend to be more responsive to price.[4]

The impact on customer use and benefits

The bill impact is only one part of the story. The price structure also affects how much customers use and the benefits they get from use. Under an IBT small users will use and benefit more and large users will use and benefit less.

By construction, there is no change in total use under the two tariff structures, but there is a difference in the value of the use. Under an IBT, small users will use more because the rate is lower than the efficient price, which implies that they value the additional use at a rate less than the efficient price. Similarly, large users will value the reduction in their use at a rate more than the efficient price. Consequently, an IBT creates an inefficient transfer from high value to small value uses.

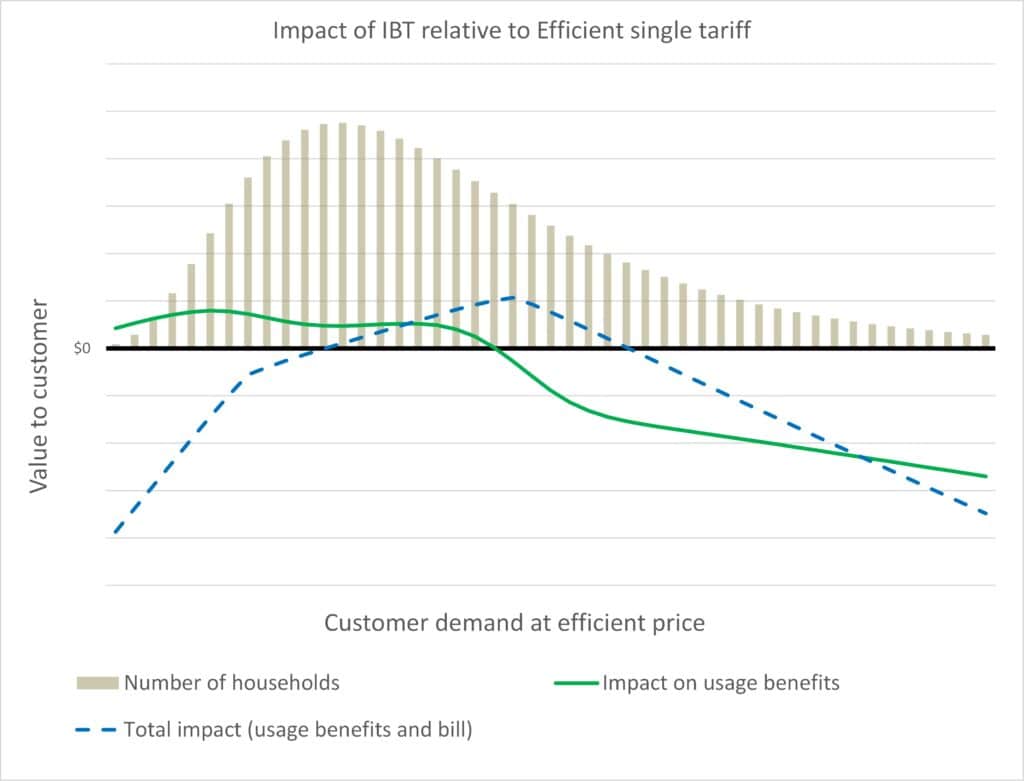

The value of the change in benefit from use is easily estimated. An example is shown in the figure below. The green line shows the change in the value of usage benefits by customer demand level. This is positive for customers with small demand and significantly negative for customers with large demand. The blue dashed line shows the combined impact on customers from the change in use and change in the bill. In summary its shows that the small users and large users are worse off under the IBT, but that a group of medium to high use customers are better off.

This aggregate impact can be estimated by multiplying and then summing across the demand levels the benefit impact (the green line) by the number customers at each level (represented by the vertical bars in figure). The size of the efficiency loss associated with the IBT depends largely on the responsiveness of demand to the change in prices. Over time there will be a larger response and large efficiency loss.

Other issues and considerations

IBTs may also increase the volatility and uncertainty of a utility’s revenues. If the utility’s usage price was set to its marginal cost of supply, then from a financial perspective the utility should be indifferent to how much its customers use. However, usage prices are often set above this marginal cost (particularly in the water sector) which leads to utilities being affected by demand volatility and the establishment of mechanisms that adjust future prices to address revenue imbalances. An IBT that increases the top tier ‘discretionary’ usage tends to accentuate the volatility.

IBTs can also create some administrative challenges. These include issues associated with billing systems and dealing with the special cases, which include missed or inaccurate meter reads and the setting of access prices that are based on a retail minus methodology.

There are also some issues to consider with the efficient tariff. These relate to reductions to the fixed charge, which will occur if the usage price is increased to incentivise conservation. First, some disadvantaged groups may not benefit from a reduction in the fixed charge because, for example, they rent from a landlord who pays the fixed charges or because the utility’s hardship policies already provide discounts on the fixed charge. To address such concerns the reduction in the fixed charge might be replaced with a fixed rebate that is provided to the party that pays the usage charges.

Second, it is possible that the reduction in the fixed charge (or rebate) is so great, that the bill for some small users is negative. This may be perceived as undesirable and cause administrative challenges. These issues might be addressed by imposing a minimum bill of zero or using an IBT with only two tiers and a very low (or zero) Tier 1 price. This latter scenario is illustrated in the figure below. This approach minimises the distortion of the IBT while ensuring each customer pays a positive bill.

Conclusion

Relative to a single price tariff alternative, IBTs are neither fair nor efficient. Contrary to common perception, IBTs result in higher bills for the small users (who tend to have lower incomes) due to the impact of IBTs on fixed charges. It is also clear that IBTs encourage inefficient use and create some administrative challenges.

So why do IBTs persist? The continued interest in IBTs may be a symptom of deeper issues with addressing the challenges of affordability and conservation. Regardless, it seems likely that there is a lack of awareness of the alternatives and the full implications of the options.

The implications of the IBT and other tariffs are reasonably easily modelled and analysed. If you would like to know more, please get in touch:

References:

[1] Natali, R. (2023, March 28). Water companies encouraged to be more creative in how they charge customers – to reduce bills and save precious water supplies. Ofwat.

[2] Watson, Nicole, Grimes, Patrick, & Sutherland, Nikki. (2023). Debate on energy social tariffs. House of Commons.

[3] Sibly, H., & Tooth, R. (2014). The consequences of using increasing block tariffs to price urban water. Australian Journal of Agricultural and Resource Economics, 58(2), 223–243.

[4] The residential price elasticity of demand for water. A joint study by Sydney Water and Dr Vasilis Sarafidis, Lecturer in Econometrics, University of Sydney. (2011).