The Australian finance industry is a large player in the economy, representing 7.5% of Australian GDP. The adoption of Generative AI in the Australian finance industry has the potential to deliver significant productive efficiency gains over the course of the next decade.

Sapere and King & Wood Mallesons (KWM) were engaged by the Australian Finance Industry Association to research the impact of artificial intelligence (AI) on the Australian Finance Industry.

The purpose of the research was to identify and analyse:

- the current and expected medium term use cases that involve the innovative use of AI in the finance industry

- the economic impact of adoption of GenAI in financial services for the Australian economy

- the regulatory challenges, risks and opportunities

- the potential governance approaches that can be adopted by organisations in relation to implementation or deployment of GenAI use cases.

In our joint report published in May 2025, we distinguished between: Narrow AI (being AI that typically provides a ‘point’ solution for a particular use case, such as decision-making based on predetermined algorithms and rules); and Generative AI (being AI that generates new content based on training data in response to prompts).

As a key input into the research, KWM and Sapere surveyed and interviewed a number of participants in the Australian finance industry on their use and adoption of AI. Participants included banks, non-bank lenders, finance companies, fintechs, providers of vehicle and equipment finance, car rental and fleet providers, as well as service providers that provide technology or AI powered services.

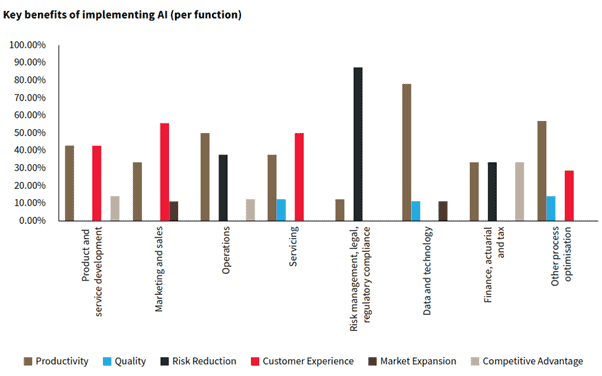

All respondents had either implemented or were trialling an AI system. However, where AI systems had been implemented – they were predominantly forms of Narrow AI in the following areas: fraud detection and prevention, cybersecurity threat detection and monitoring, abuse detection, stress testing and risk management, document processing, customer tailoring and personalisation and traditional chatbots.

The majority of respondents said they have been piloting /experimenting with GenAI for the past 12 to 18 months with emerging use cases in two areas: employee productivity (including: internal chatbots, process automation, dealing with unstructured data, developer augmentation) and business processes (including: preparing/reviewing internal documentation, automating quality assurance, identifying financial hardship, automated call notes, scenario modelling and marketing content).

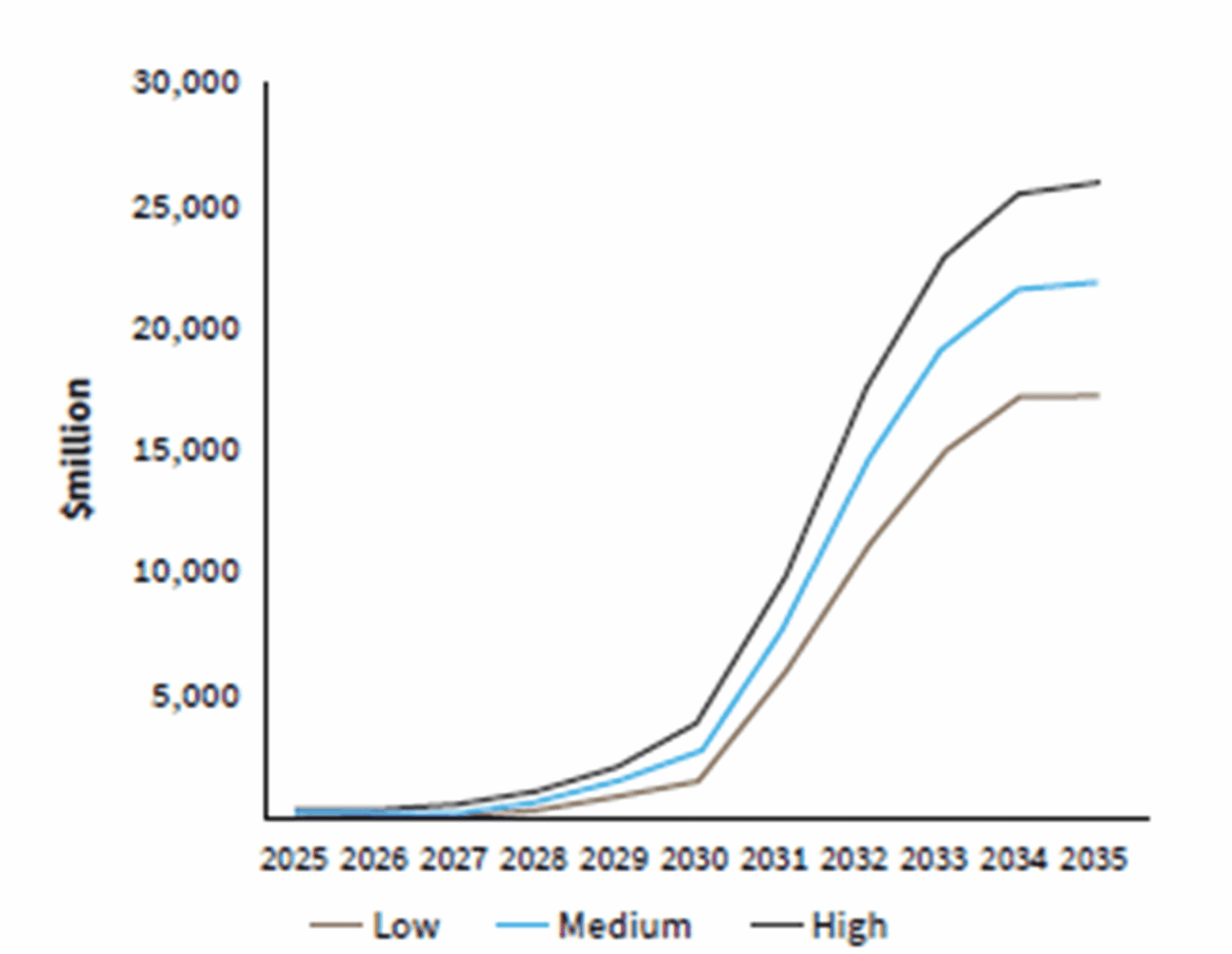

The economic impacts from the adoption of Generative AI in the Australian financial services industry will derive from net operational savings to businesses operating in the industry. The estimates of wider economic benefits to Australia derive from additional investments and jobs that result from the productivity gains in the finance industry.

Considering the feedback directly from AFIA members, and triangulating forecast impacts in published research by the Tech Council of Australia, McKinsey and Citi, we developed three scenarios (low 5%, medium 9% and high 13%) for the direct productivity savings that could be generated through the adoption of Generative AI. These estimated productivity gains provided the basis for modelling the potential scale of economic impacts to the Australian economy.

The findings of our report were that the adoption of GenAI by the finance industry is projected to cumulatively add $48.9 billion to GDP by 2035 (in NPV terms) under our medium scenario. This would represent an increase of $690 per capita annually in additional GDP by the year 2035.

Our team included:

- David Graham

- Jeremy Thorpe

Wondering what AI means for your organisation or the broader financial sector?

Sapere provides independent, evidence-based analysis to help financial institutions, regulators, and policymakers navigate the economic impacts of emerging technologies. Get in touch to see how we can support your strategy or regulatory response in this changing landscape.